We are a global operator of essential infrastructure

- The company will invest 421.4 million euros in Red Eléctrica to meet the goal of reaching 1 billion euros for the year

- Revenue and net profit for the half-year amounted to 910.8 million euros and 269.3 million euros, respectively. They were also impacted by the end of the regulatory useful life of assets commissioned before 1998, as anticipated by the company.

- Excluding this effect, the group’s revenue would have increased by 1.6% in this first half-year, while net profit would also have increased by 5.2%

Redeia's investment plan to speed up the process towards the ecological transition in Spain has gained momentum in the first half of 2024. The company’s investments in the transmission grid and the operation of the electrical system during this period amounted to 421.4 million euros, exceeding the figure from the first half of the previous year by 19.2%. The investment effort dedicated to developing the national transmission grid has been particularly intense, with 366.7 million euros allocated to this area, compared to 320.5 million euros in the same period last year.

This financial boost aligns with the group’s annual goal of reaching 1 billion euros in Red Eléctrica, aimed at continuing to drive and facilitate the transformation of the national energy model. In total, the group’s investments during this period exceeded 456 million euros, 10.5% more than between January and June 2023.

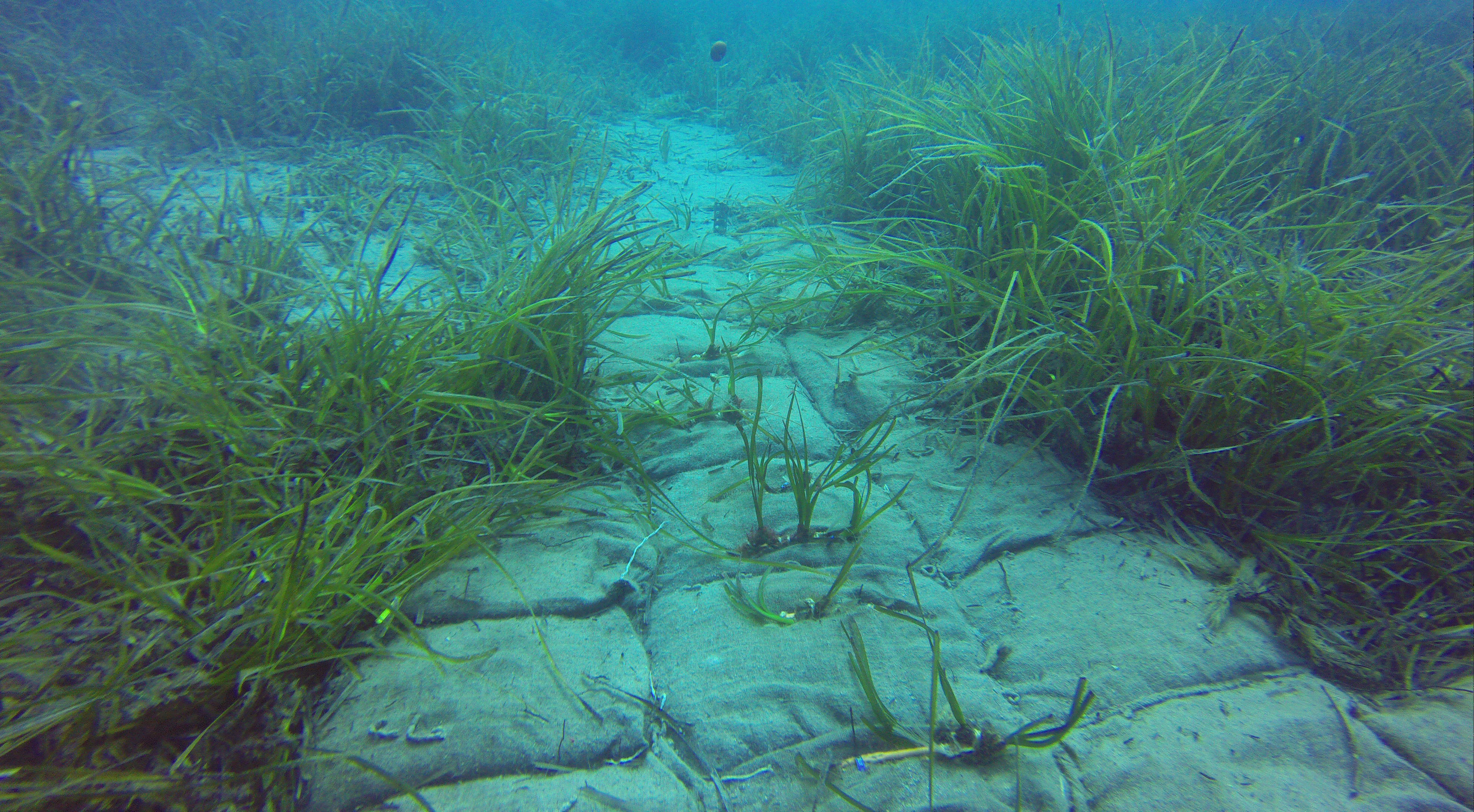

These resources have translated into new progress in the execution of the projects included in the current electricity planning, resulting in new lines, sub-stations, and significant steps forward in international and inter-island interconnections. In this regard, the interconnection between Spain and France through the Bay of Biscay continued as planned in the first half of the year, as well as the Galicia-Portugal axis, highlighted by the commissioning of the Beariz sub-station in May. Additionally, the works for the mainland-Ceuta link began, aimed at improving the security and quality of supply in the Ceuta electrical system, following the granting of the prior administrative authorisation in June. Regarding the La Gomera-Tenerife interconnection, key for integrating the electrical systems of both islands and achieving greater renewable integration, the sub-station works are progressing steadily.

Among the multiple milestones for transmission projects across the territory, this half-year saw the completion of the public works for the underground line between Eivissa and Platja d’en Bossa on the Pityusic Islands and the finalisation of the new 400 kV Almendrales sub-station in Mequinenza (Zaragoza) for its upcoming commissioning. Beyond the planning, the construction of the Salto de Chira pumped-storage hydroelectric power station in Gran Canaria is going ahead, which is crucial for the energy transition in the Canary Islands.

Revenue and results

Revenue (including business turnover and the share of profits from equity-accounted companies) stood at 948.3 million euros, primarily impacted by the end of the regulatory useful life of assets licensed before 1998 - known as pre-98 assets - as introduced by Royal Decree 1047/2013 of 27 December.

This change in the transmission remuneration calculation methodology has been prepared for by the company over the past years. Excluding this pre-98 impact, the group's revenue would have increased by 1.6% in this first half-year, with EBITDA and net profit also seeing a rise (+3.5% and +5.2%, respectively).

The group's ongoing commitment to an unprecedented increase in its investments will allow the current year to mark the beginning of a period of revenue growth.

This scenario has resulted in a lower contribution from the transmission activity in the electrical infrastructure management and operation business, which closed the half-year with revenue of 691.3 million euros. In contrast, the system operation activity generated 1.7 million euros more than in the same period in 2023.

The telecommunications activity reported 200.1 million euros to the group in the first half of 2024, exceeding the volume from the same period in 2023 by more than 6 million euros. This is explained by the satellite business results, which improved by 4.4% compared to the same period last year, reaching almost 124 million euros. Profits in the fibre optic activity also improved, generating revenue of 76.2 million euros.

Revenue from international electrical transmission - including the results of equity-accounted companies - reached 73.5 million euros, 5.1% higher than in the same period in 2023.

Gross operating profit (EBITDA) reached 681.3 million euros, while net operating profit (EBIT) stood at 413.7 million euros. On the other hand, the group's net profit was 269.3 million euros, in line with the company’s forecasts.

As of 30 June 2024, net financial debt stood at 5,111.2 million euros, 2.7% higher than at the end of 2023. Regarding its financial structure, the company maintains a solid position with diversified debt sources and a credit rating reaffirmed by S&P at ‘A-’ with a stable outlook, the same rating assigned by Fitch.

Regarding dividends, on 1 July, Redeia paid the additional dividend for the 2023 financial year amounting to 0.7273 euros per share. As a result, the total dividend paid for that year amounts to 1 euro per share, as outlined in the group’s strategic plan.

66% of group financing is sustainable

In line with its commitment to linking its financing to ESG criteria, the company launched two new green bond issuances in the first half of the year, making a total of five in its history. The 3 January issuance for 500 million euros was followed by the recent issuance on 27 June 2024, for the same amount. These operations have allowed the company to increase its sustainable-financed debt to 66%, up from 59% in December 2023. Therefore, Redeia has surpassed its midterm target of 60% set for 2025 and is moving towards the goal of 100% by 2030.

Its commitment to sustainability also extends to Latin America, where the company recently held its ‘First Sustainability and Energy Day: The Sustainable Future Lies in Ibero-America’ in Peru through its subsidiary Redinter, which recently celebrated its 25th anniversary. Additionally, Redeia has been recognised by the consultancy Brand Finance as the fastest-growing brand in the energy sector, having increased its brand value by 77% at the end of 2023. It was also considered the third-most equal company in Spain by Equileap (Gender Equality Report & Ranking).