We are a global operator of essential infrastructure

- The investments of the subsidiary Red Eléctrica to promote the energy transition in Spain increased by 74%, representing a growth of 51.2% in the group’s overall investments for the year.

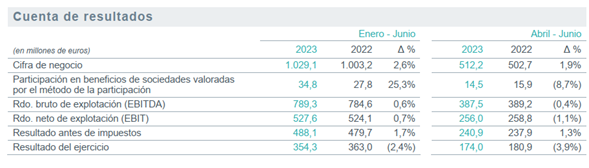

Redeia posted a net profit of €354.3 million for the first half of 2023, a figure that is 2.4% lower than that reported for the same period in 2022.

Total revenues (revenue and profit of the investees) totalled €1,063.9 million, up 3.2% on the results recorded last year between January and June, mainly thanks to the momentum of the diversification of the group’s businesses. The slight drop in revenue from the regulated business in Spain - due to the application of the remuneration adjustments arising from the final tariff regulations from 2016 to 2019 - has been largely offset by the good performance of electricity transmission operations abroad.

Specifically, Redinter's revenues were 21.2% higher than those recorded for January to June 2022, mainly due to the commissioning of facilities in Chile and Peru, the work carried out on by third parties and the favourable effect of the currency exchange rate. The incorporation of new assets in Brazil and the good results of the joint venture Transmisora Eléctrica Norte (TEN) in Chile also contributed to the improvement of the semester’s results.

For its part, revenues from the telecommunications business also represented a significant boost, with revenues 14.7% higher than in the previous year, thanks to the contribution of the satellite and fibre optic subsidiaries.

Gross operating profit (EBITDA) reached €789.3 million, representing an increase of 0.6% in the same period last year. The efforts made by Redeia in terms of efficiency, the good evolution of revenues and the contribution of the companies in which Redeia has a shareholding within Redinter's perimeter have contributed to this increase. The net operating profit (EBIT) reached €527.6 million, a growth of 0.7% year-on-year.

Net financial debt closed the month of June at €4,312.7 million, a figure that is 6.9% lower than in the previous year. This decrease is mainly due to the issuance last January of a 500- million-euro green hybrid bond with a coupon rate of 4.625% included in the group's equity. The positive cash flow generation also contributed to the evolution of this indicator.

This financing instrument has contributed to the fact that, as at 30 June, the group's financing that incorporates ESG criteria stood at 57%, compared to 42% as at 31 December 2022. Redeia has set itself the objective of having 100% of its financing contracted based on ESG criteria by 2030.

The results for the first half of the year bolster the company's solid financial position. In this regard, in June the credit rating agency Standard & Poor's confirmed Redeia's rating at 'A-/A-2' with a stable outlook.

With regard to the dividend payout, on 3 July, Redeia paid out a final dividend of 0.7273 euros for the 2022 financial year. Thus, the total dividend paid against 2022 profits amounts to 1 euro per share, as set out in the group's current Strategic Plan.

Investments: boosting the green transition in Spain

Redeia's investments in the first half of 2023 continued their growth trend. From January to June 2023, its investments exceeded €413 million, 51.2% more than in the same period last year. Particularly significant was the boost in investments linked to the management and operation of the national electricity grid infrastructure, which totalled €353.5 million, an increase of more than 74% for the period January to June last year.

In this regard, Redeia’s subsidiary, Red Eléctrica, continues to make efforts to facilitate the green transition in Spain. In this period, the TSO has allocated more than €320 million to the bolstering and development of the transmission grid in line with the Transmission Grid Planning currently in force.

This investment programme has been decisive in making progress in fulfilling the current Transmission Grid Planning, such as the commissioning of the Ibiza-Formentera inter-island subsea link or the Astillero-Cacicedo electricity axis, the start of work on the Tenerife-La Gomera submarine link, or the permitting processes of important projects such as the electricity interconnection with France across the Bay of Biscay, among others.

In addition to the investment established within the Transmission Grid Planning, the subsidiary has earmarked €24.2 million to continue with the first phase of the construction work for the Salto de Chira pumped storage hydroelectric power station in Gran Canaria.

In this financial period, investment linked to the group’s telecommunications business has also experienced a major boost. Hispasat increased its investment with respect to the first half of 2022 due to the launch of the Amazonas Nexus satellite on 7 February: €38.4 million, an increase of €5.3 million compared to last year. The Nexus satellite reached its orbital position and came into operation on 15 July, with 80% of its capacity committed.

For its part, investment in the fibre optic business increased from €2.7 million in the first half of 2022 to €5.3 million this year, due to the progress made in Reintel's investment plan focused on the renewal plan of the railway fibre optic network.

Internationally, the subsidiary Redinter focused on completing its major investment projects in Chile and Peru.