We are a global operator of essential infrastructure

- Red Eléctrica will invest 4 billion euros over the next five years in the reinforcement of the transmission grid

- Renewable energy has accounted for 40% of the generation during the first quarter of the year

- The dividend proposed this year grows 15.5%

Today, during the press conference held prior to the General Meeting, the Chairman of Red Eléctrica de España, Luis Atienza, evaluated the 2009 financial year and detailed the main challenges the company has for the next few years, pursuant to its Strategic Plan. This year, Red Eléctrica celebrates its 25th anniversary.

Luis Atienza highlighted the change in the trend of the electrical energy demand, which, since the beginning of this year, has experienced an accumulated increase of 5%, rate that reaches 3.5% if the effects of seasonal and working patterns are factored in. The demand growth forecast, one of the indicators usually used to anticipate the behaviour of the economic activity, has been revised upwards for 2010 bringing it to 1.5%.

In regard to Red Eléctrica's contribution to the achievement of the energy policy goals, Atienza emphasized the company's effort to develop a more robust transmission grid and better interconnected with the neighbouring countries. Its Strategic Plan, reference framework for REE's investments, contemplates an annual investment of 800 million euros, reaching a total of 4 billion euros over the next five years. It represents an essential challenge for our electricity system that will make the transformation of the sector possible and will prepare it for the future. These investments are necessary for the reinforcement of the security of the system, as well as to make the renewable energy goals feasible, support the development of the High Speed Train and strengthen the international interconnections.

In this sense, Luis Atienza pointed out the relevance of the new interconnection line with France through the Eastern Pyrenees, to be commissioned in 2014, "which will double our current exchange capacity with Europe increasing it to 6% of the maximum Spanish demand", and indicated also that the interconnection is a technological challenge due to its special technical characteristics, as it will be an underground direct current link along a 70-kilometre stretch.

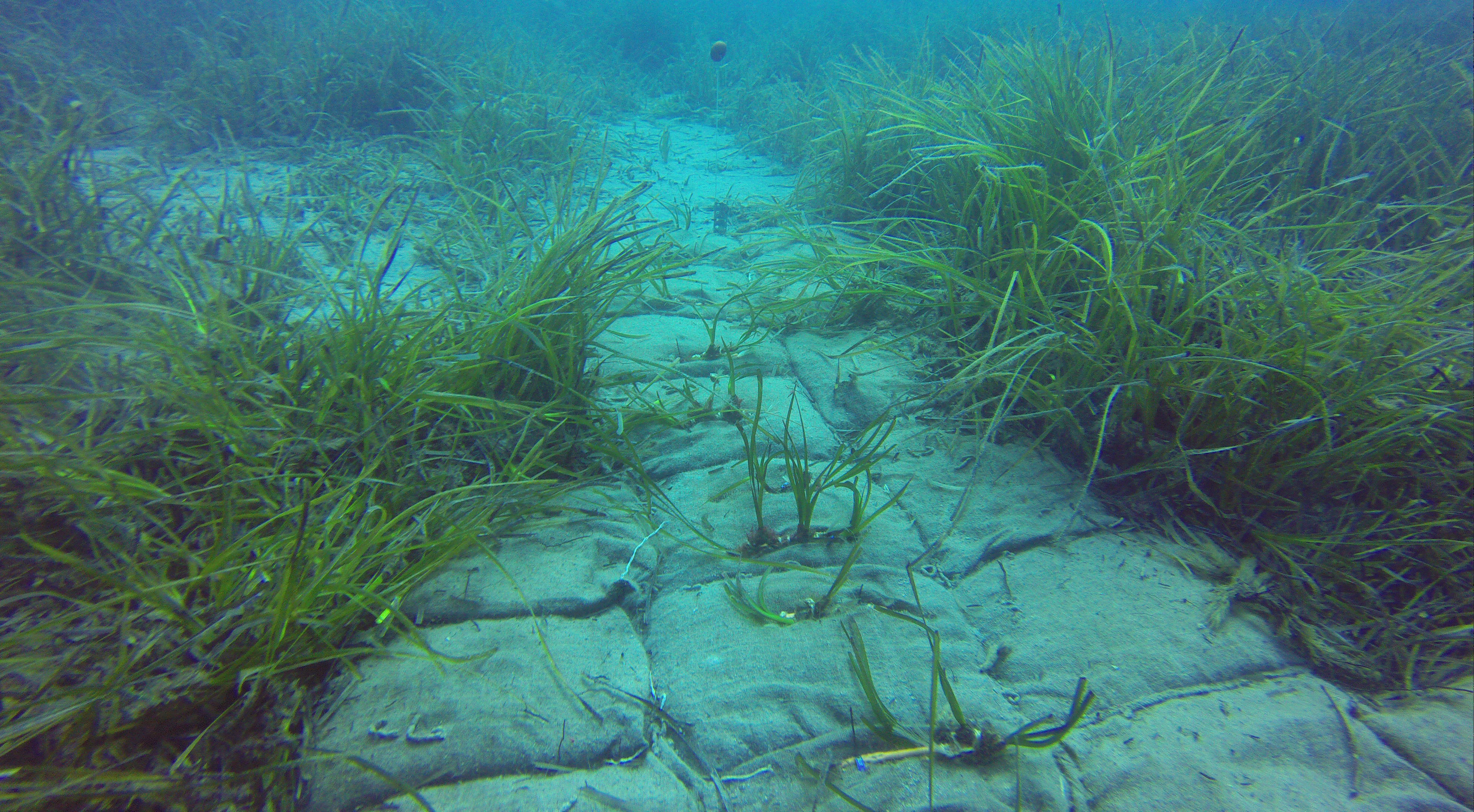

Atienza also highlighted two projects that test the technical capability of the company: the submarine connection that will link the Peninsula with the Balearic Islands and the electricity link between the islands of Ibiza and Mallorca, "both worldwide reference milestones owing to their technical complexity". These two projects, along with the interconnection with France, signify an overall investment of 1 billion euros.

A more sustainable energy model: greater integration of renewables and demand side management

In addition to investing in new facilities in order to have a more robust, meshed and reliable grid, the Chairman of Red Eléctrica stressed that to improve the sustainability of our energy model "Red Eléctrica works to achieve a greater integration, under secure conditions, of renewable energies in the system and in this way reduce the CO2 emissions". Also among its objectives is to drive the intelligent management of the demand.

Red Eléctrica, according to Atienza, "has known how to anticipate itself to the importance of renewables and has looked for solutions instead of pointing out problems, which has helped us become a worldwide reference in the integration of renewables". The tools with which the company has equipped itself, in order to make this possible in a secure manner, shall allow for an installed wind power capacity of 20,000 megawatts by the end of 2010.

Renewable energies have so far covered 40% of the demand in 2010, owing to exceptional meteorological conditions that have made it possible to count on a significant increase in the generation originating from both wind power and hydroelectric. This has permitted to reduce the CO2 emissions derived from electricity generation by 45% in the first quarter of the year. If this trend continues, 2010 could be the year in which the electricity sector generates the least amount of CO2 emissions since 1990.

In order to achieve that 40% of the electricity consumption be obtained from renewable sources in 2020, "it is necessary to continue contributing solutions to the system operation by driving initiatives in demand side management". According to Luis Atienza, "the implementation of measures destined to achieve a more efficient consumption and a greater flexibility of the demand are essential for the optimization of the generation capacity".

The Chairman of Red Eléctrica highlighted the following as demand side management tools: the increase in pumping capacity, which will avoid the dumping of wind energy and will allow for more renewables and more security; the electric vehicle, whose slow recharge at night will allow to take advantage of the idle capacity of generation and grids, as well as to absorb surplus renewable energy that is generated during the night; and the development of automated and flexible grids, that combined with more intelligent electric meters and devices shall allow consumers to adjust their decisions to the availability of the offer or to the needs of the system at a given moment.

Financial soundness and commitment with shareholders

Lastly, Luis Atienza reviewed the key economic data for the 2009 financial year, highlighting the company's positive results. Last year, the Red Eléctrica Group obtained a consolidated after-tax profit of 330 million euros, which represents an increase of 15.5%. The dividend for the 2009 financial year, which will be submitted for approval at the General Meeting, is 15.5% higher than that of the previous year.

Gross operating result (EBITDA) was 845.6 million euros, 9.6% higher than the previous year. Additionally, net turnover increased 6.6% and reached 1.2 billion euros.

Total investments of the Group rose 19.4%, reaching 758 million euros, of which 735 million correspond to investments in the transmission grid. Despite this important investment effort and as a result of the cash flow generated during the financial year, the company maintains a high financial soundness, as demonstrated by the ratings awarded by the rating agencies, AA-, in the case of Standard & Poors, and A2, in the case of Moodys.