We are a global operator of essential infrastructure

- The Company will maintain a dividend growth in line with profit, with a payout of 65%

- €672 million euros was invested in the transmission grid in 2012, which resulted in 860 kilometres of new line circuits being put into service

- The Board will propose to the Meeting the creation of the post of the Lead Independent Director, in line with international best practices regarding corporate governance

Red Eléctrica forecasts an increase in its profit of between 6% and 8% in the coming years, with investments that will total 2.8 billion euros, according to a statement made by the Chairman of the Company, José Folgado, at a press conference held prior to the Annual General Meeting to be held tomorrow in Madrid. Of the stated amount, which is contemplated under its 2013-2017 Strategic Plan, 25% (about 700 million) will be invested in the Balearic Islands. Mr. Folgado stressed that the Company will maintain a dividend growth in line with profit, with a payout of 65%.

The Company, which posted a net profit in 2012 of 492 million euros, an increase of 6.9% on the previous year, last year invested 672 million euros in the transmission grid, which resulted in 860 kilometres of new line circuits being put into service. At the Annual General Shareholders' Meeting, the Board of Directors of the Company will propose, amongst other things, the creation of the post of the Lead Independent Director, in line with international best practices regarding corporate governance.

José Folgado presented the Company's strategic objectives for the coming years and the various proposals related to corporate responsibility and good governance that will be submitted for shareholder approval. The Chairman began his speech with a reflection on the complexity of 2012 in terms of the regulatory framework, the situation regarding investments and the nationalisation of Red Eléctrica's subsidiary in Bolivia, Transportadora de Electricidad (TDE).

On this last point the Chairman stated: "After a long period of almost a year, we have only obtained reference values for the company from the Bolivian government that are well below their fair value, therefore, we are waiting for the Bolivian government to reconsider before resorting to international arbitration proceedings". In addition, he pointed out that this process will not have a negative impact on the financial statements of Red Eléctrica, due to the fact that provisions for it its book value were made during recent years.

Solid financial performance in 2012

Mr. Folgado clarified that, despite this context, the Company achieved solid financial results, with a significant strengthening of its key solvency ratios. Consolidated net revenue grew by 7.2%, mainly due to revenues associated with the commissioning of assets in 2011, and incorporates the impact of the measures of RD 20/2012 and the deconsolidation of TDE after its expropriation. The gross operating result (EBITDA) grew to €1.299 billion, an increase of 6.9% on the previous year.

From the point of view of the evolution of the balance sheets, the increase in debt reflects the effect of the one-year delay in the remuneration of commissioned facilities and the elimination of the free choice of depreciation method. In this regard, the Chairman pointed out that, despite this increase, the debt coverage ratio "Net debt over EBITDA" has continued to improve, reaching levels of 3.8 times. "Our financial management has allowed the average cost of our debt to be 3.8% in 2012", he added.

With regard to our performance on the stock market, 2012 was positive. The behaviour of the value of Red Eléctrica has differed substantially to that maintained by the IBEX, recording a gain of 12.8%, in line with the average increase of the European markets.

Regarding transmission, as a result of the kilometres of new circuits put in service in 2012, the grid now has 41,000 kilometres distributed throughout the country. The investment effort of the Company has focused on the structural strengthening of the grid and the development of international interconnections. "In this way, Red Eléctrica fulfills its mission to make available to all market agents, an efficient, safe and reliable electricity transmission grid operated with criteria of neutrality and independence", explained Mr. Folgado.

Interconnections and the integration of renewable energies

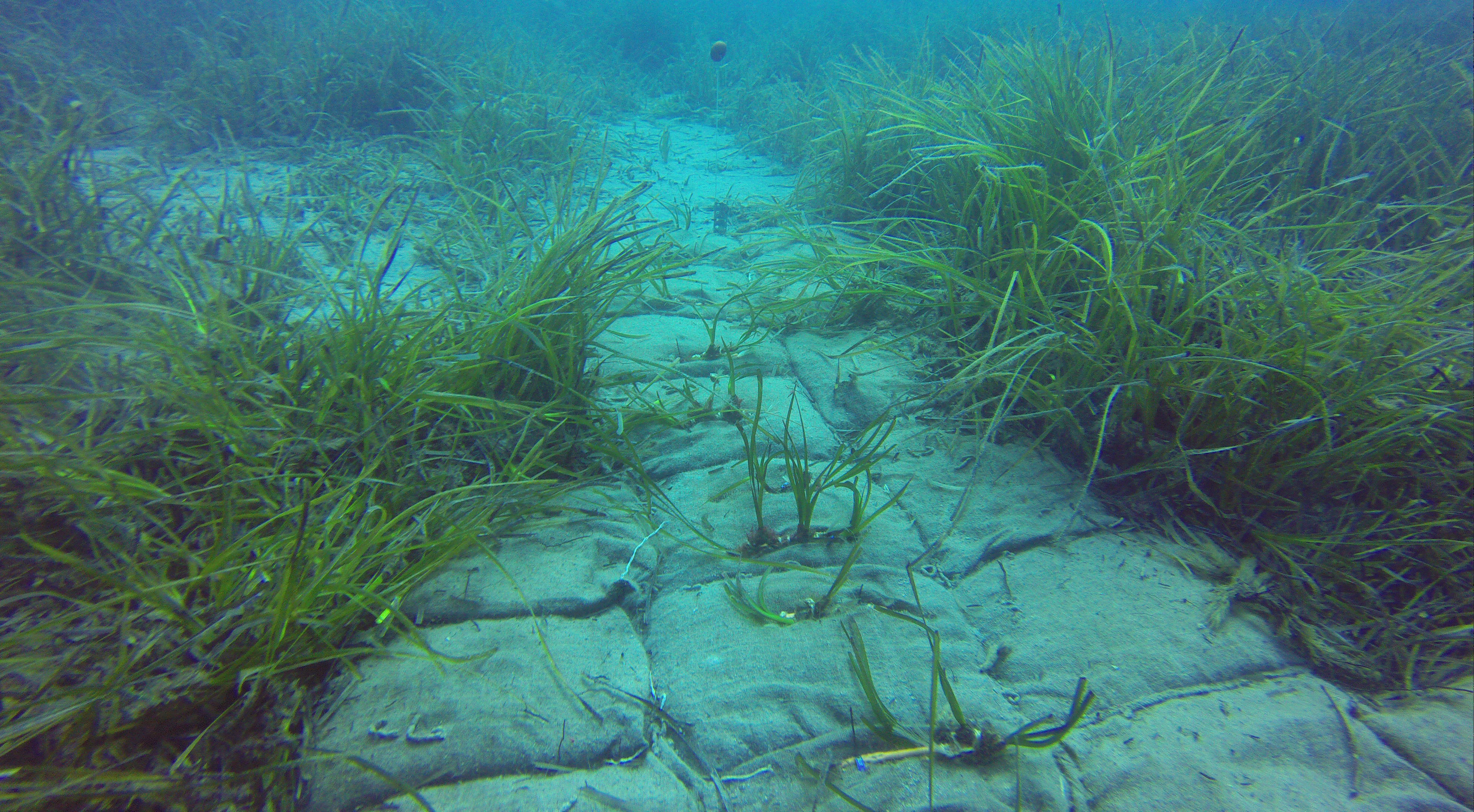

The investment plan for this period is consistent with the current economic environment and includes investments of between 550 and 600 million euros a year, for which 125 and 150 million will be earmarked for improving extra-peninsular electricity infrastructures, and between 425 and 450 for international interconnections and other investments needed to strengthen meshing of the peninsular grid. José Folgado highlighted the importance, from the point of view of security of supply and the structuring of the territory, of the Majorca-Ibiza submarine interconnection that will link the two electricity subsystems Majorca-Menorca and Ibiza-Formentera.

Regarding the strengthening of international interconnections, key will be the new interconnection with France whose commissioning is scheduled for late 2014. With it, the current exchange capacity will be doubled reaching 2,800 MW. In addition, a new interconnection for the 2020 horizon is being studied, from the Basque Country, that would be a submarine link across the Bay of Biscay.

Red Eléctrica continues to work in order to achieve increasingly better integration of renewable energies into the electricity system, which will allow a reduced dependence on foreign energy. In this regard, noteworthy is the work of the Control Centre of Renewable Energies (CECRE) which, for the fourth consecutive year, has made it possible for nearly one third of global production in the peninsular system to be produced by renewable energy; specifically 32% in 2012.

The Chairman insisted that we must strive for greater electrification of the country that will allow our own energy sources to be taken advantage of and reduce external dependence by reducing the use of hydrocarbons in transportation. "The most important challenge is to ensure that energy becomes the driver for technological development, increased economic activity and job creation and is no longer a limiting factor for growth", he added.

Corporate Responsibility and Good Governance

In order to introduce new practices regarding corporate governance, the proposal to amend the Articles of Association will be raised at the Annual General Meeting. The Board of Directors created, last March, the figure of the Lead Independent Director and decided to submit this for consideration and approval by the Shareholders.

Another change reflected in the Articles of Association of the Company, and which has already been implemented for more than a year, is that the two committees of the Board of Directors, the Audit committee and the Corporate Responsibility and Governance committee, are composed exclusively of external Board members, with a majority of independent directors and are chaired by independent directors. In addition, transparency regarding the remuneration policy of the Board and Senior Management has been increased. Remuneration for 2012 was reduced by about 5% compared to 2011. With the incorporation of these improvements in corporate governance, the Company meets all of the 58 recommendations of the Unified Code of Good Governance.