We are a global operator of essential infrastructure

- Renewable energies covered 35% of the demand, seven points higher than last year

- Investment in the transmission grid in 2010 reached 865 million euros

- The interconnections with Europe, the most important investments in the Spanish electricity system this decade

- Red Eléctrica completes the model of being sole operator and transmission agent of the Spanish electricity system

Today, during the press conference held prior to the General Shareholders' Meeting, the Chairman of Red Eléctrica de España, Luis Atienza, presented the 2010 financial results in addition to the strategic objectives the company has for the next few years.

Luis Atienza emphasized that in 2010 Red Eléctrica had completed the model of sole operator and transmission agent in the Spanish electricity system, with the acquisition of the transmission assets which still belonged to electric utility companies, not only on the Spanish peninsula, but above all, on the Balearic Islands and the Canary Islands. Red Eléctrica is now owner and manager of the whole electricity transmission grid within the country, which reinforces its independence and neutrality in the Spanish electricity system.

The investment effort over recent years in the improvement and expansion of the grid has been fundamental in consolidating this model. "We have gone from 243 million euros annually in 2004 to 865 million in 2010, a period during which approximately 2,800 km of new electricity circuits have been put into service, 839 km of them during this last financial year". These new facilities have been destined mainly to the structural reinforcement of the grid, to the creation of new energy transmission axes and to grid node meshing, with the purpose of guaranteeing the security and stability of the electricity supply, and to manage the variability of the electricity flows derived from the production of renewable energy.

For the period 2011-2015 Red Eléctrica will maintain this rate of investment reaching 4 billion euros so as to guarantee a safe, efficient and quality supply for consumers.

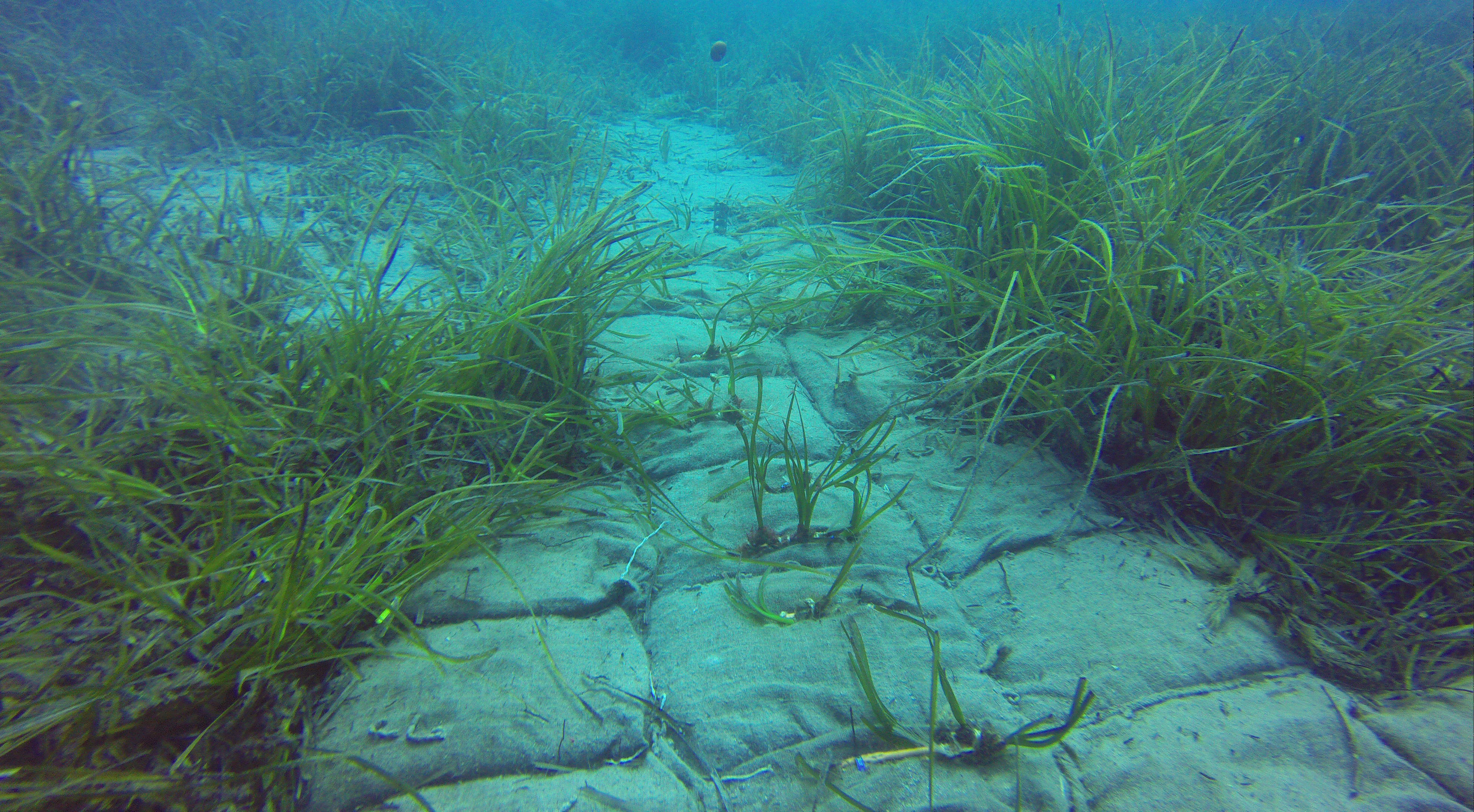

The investment capacity of Red Eléctrica, and their technological capacity, is also shown in three projects of world reference due to their technical complexity: the submarine connection between the Spanish peninsula and the Balearic Islands, that will go into service this year, the electricity connection between the islands of Majorca and Ibiza, and the new interconnection line with France, the most important project that the company is undertaking over the coming years.

This 400 kV line, whose commissioning is predicted for the end of 2013, will be the first interconnection with the European transmission network to be commissioned for almost 30 years. Mr. Atienza emphasized that this new interconnection will provide a greater security of supply and will allow us to take better advantage of renewable energies. Nevertheless, he insisted that "If we want to continue integrating more renewable we must set ourselves the objective of developing new interconnections for the 2020 horizon, until reaching an interconnection capacity of at least 6,000 MW". The interconnections with the rest of the European electricity system are the most important investments of the Spanish electricity system in this decade.

Similarly, Mr. Atienza indicated that in line with the slight rise in the economy, energy consumption had showed growth in 2010. The demand for electrical energy grew 2.9% in the past year. This trend seems to continue, although with greater moderation, in the first few months of 2011, in which the demand growth for the first quarter was 1.1%.

World leader in the integration of renewables

2010 has also been the year in which Red Eléctrica consolidated its position as world leader regarding the integration of renewable energies. The company has continued working with the objective of giving renewable energy an increasingly more important role within the energy sources that make up the generation mix.

This continued effort has contributed to the fact that in the last year the production coming from renewable sources covered 35% of the total demand of the peninsular system, seven points more than the previous year. The contribution of wind power generation, with a participation of 16%, has turned this technology into the third energy source in the coverage of the demand, only behind combined cycle and nuclear energy. The leading role played by wind power was demonstrated once again in March 2011, when this technology surpassed for the first time, with a contribution of 21%, the rest of the technologies in the electricity demand coverage.

In order to compensate for the lesser manageability and predictability of renewable generation, Mr. Atienza emphasized the importance of promoting a more efficient management and an interactive behaviour of the demand that increases the consumption in those hours of lesser demand and reduces it in peak hours.

The effective management of the demand, the use of the pumped-storage power stations as storage to service the operation of the system, the promotion of other energy storage technologies and the development of intelligent charging, in particular that of the electric vehicle, are some of the solutions that are the foundation of Red Eléctrica's vision of future as operator of the electricity system.

"The drive for the implementation of the electric vehicle can become an important development for fossil fuel substitution and the improvement of air quality and the noise in cities", stated Mr. Atienza. In order for it to become an ally of a more efficient electricity system, with greater penetration of renewables, it is important that an intelligent management system be developed, that is sufficiently flexible to adapt to the needs of consumers, but which encourages incentives for its charging outside those hours of maximum electricity demand.

Financial results

Luis Atienza gave a summary of the 2010 financial year emphasizing the influence that the acquisition of the transmission assets has had. Net profit grew to 390 million euros, 18% more than in the previous financial year, and the EBITDA of the Group surpassed for the first time 1 billion euros.

Shareholder remuneration by means of the dividend payment was 1.88 euros per share and reflects the fulfilment of our commitments to maintain an attractive dividend for our shareholders in line with the increase in earnings per share.

All this reflects a solid financial structure, recognised by the credit rating agencies, who have again confirmed a rating level of AA -, in the case of Standard & Poor's, and A2, in the case of Moody's.