We are a global operator of essential infrastructure

- Total investments reached €464.4 million, up 14.9% on that invested in the first nine months of 2018.

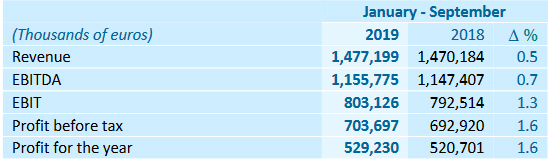

Results of the Red Eléctrica Group during the first nine months of 2019 continue to be in line with its objectives defined in its 2018-2022 Strategic Plan, reaching a profit of €529.2 million, 1.6% higher than the figure recorded in the same period last year. In addition, the gross operating result (EBITDA) totalled €1,155.8 million, 0.7% higher than the figure obtained in 2018.

During the first nine months of 2019, the Group's investments stood at €464.4 million, up 14.9% on the same period in 2018. Of this total, €235.3 million were earmarked for the development of the national transmission grid.

In this regard, the electricity transmission and system operation activities in Spain have been aimed at facilitating the energy transition and enabling the proper integration of renewable energy. Therefore, from January to September 2019, 35.6% of the national electricity generation came from renewable sources and 58.5% was produced using CO2-free technologies.

Regarding the electricity transmission activity abroad, on 18 July, the Group, through Red Eléctrica Internacional, formalised the acquisition of 100% of the Carhuaquero-Moyobamba line in Peru, valued at 205 million dollars. This commercial transaction was announced in December 2018.

With regard to the telecommunications business, the acquisition of the remaining 89.68% of the shares of Hispasat, S.A., worth €933 million, from Abertis Infraestructuras, S.A. was formally concluded on 3 October. This financial transaction will be included in the Red Eléctrica Group’s financial statements as at 3 October.

The agreement for the acquisition of Hispasat has positioned the Red Eléctrica Group as a global operator of reference of electricity and telecommunications infrastructures, both in Spain and internationally, in line with the goals undertaken by the Company in its 2018-2022 Strategic Plan.

With regard to other aspects, the Group’s management during the period was marked by a prudent financial policy in which efficiency and cost containment have prevailed. The net financial debt of the Red Eléctrica Group stood at €4,973.4 million and the average cost of financial debt was 2.32%, compared to 2.42% in the same period last year.

At its meeting in October, the Board of Directors of the Red Eléctrica Group agreed to pay an interim dividend for 2019 in the amount of €0.2727 per share. This dividend will be paid for all shares with dividend rights on 7 January 2020.