We are a global operator of essential infrastructure

- The Company will invest €4.4 billion over the period, of which more than €3.3 billion will be invested in the transmission grid, international cross-border connections, energy storage and system operation, accounting for 75% of the investments contemplated in the Plan.

- The consolidation of the international activity will contribute to annual EBITDA growth of around 6% until 2025, driven by the commissioning of projects in progress and by the acquisitions made in recent years.

- Hispasat is embarking on a new phase to facilitate universal connectivity, which is the basis for digitalisation, as the main vehicle for expansion and that will enable an annualised EBITDA improvement of more than 5% over the period.

- The new Plan will allow the Group to consolidate its leadership in sustainability and, in particular, in the fight against climate change.

- The Company maintains its commitment to keep a dividend per share of 1 euro until 2022, and to keep it at least at 0.80 euros thereafter, in order to robustly support the strong investments foreseen.

- The Group’s results in 2020 amounted to €621.2 million in a year characterised by the entry into force of the new regulatory parameters and the effects of COVID, especially in the satellite business, which have led the Group to update the valuation of Hispasat's assets.

The Chairwoman and the CEO of the Red Eléctrica Group, Beatriz Corredor and Roberto García Merino today presented the new 2021-2025 Strategic Plan approved by the Board of Directors of the Company and which is based on three fundamental pillars: maximum engagement with the energy transition, boosting connectivity solutions and the consolidation of its international business. In the words of the Group's Chairwoman, it is "a plan that will enable us to play our role in vital processes for our country such as the energy transition and the reduction of the digital divide."

For his part, Mr. García Merino stressed that the Company's purpose is based on "guaranteeing the electricity supply and connectivity in the field of telecommunications, promoting sustainability criteria, a fair ecological transition, showcasing our neutrality and contributing to social and territorial cohesion."

With all this in mind, over the next five years the Company will launch a series of actions to make the energy transition a reality to the tune of €3.3 billion - 75% of the Plan's total investment - among which noteworthy is the development of the necessary infrastructure for the transmission grid, set out and included in the 2021-2026 Transmission Grid Development Plan proposal, currently in the Public Information stage, to achieve a carbon-neutral economy and whose investment totals more than €2.8 billion. It will also promote the increase in energy storage capacity, as a tool at the service of system operation, with an investment of €411 million, which will enable a greater integration of renewable energy and at the same time provide greater security to the electricity system. In addition, the Company will continue to prepare itself to operate an increasingly complex and integrat-ed system in Europe and will invest €92 million with this purpose in mind.

Therefore, the regulated business will have a sustained investment plan for the next five years, reaching a higher rate of investment at the end of the 2021-2025 period, and which will continue beyond this horizon.

Another of the Group's strategic lines is the consolidation of its international business. The Company, which is already present in Peru, Chile and Brazil, sees this strategic line as a natural way to strengthen its core business: the construction and management & operation of electricity transmission grids.

Thus, with a planned investment of €225 million, the Group is committed to the consolidation and organic growth of the electricity business in these three countries, reinforcing its presence there, consolidating and strengthening existing businesses to enable organic business development and the optimisation of the Group's existing assets, and seeking new business opportunities.

The consolidation of the international activity will contribute an annual EBITDA growth of around 6% until 2025, driven by the commissioning of projects in progress and by acquisitions made in recent years.

Red Eléctrica has been present in South America for 20 years, where it manages 4,459 km of line circuit with excellent availability rates. To date, the Company has invested more than €1.3 billion in assets abroad in Peru, Chile and Brazil, countries where it has a firm commitment to remain and where, in recent years, it has found new business opportunities.

Boosting telecommunications

Another of the main pillars of Red Eléctrica's new roadmap is based on boosting telecommunications to facilitate connectivity through, on the one hand, the deployment of satellite capacity to reduce the digital divide and provide coverage to remote areas that fibre cannot reach; and on the other hand, furthering the development of the fibre optic business, and developing new opportunities around 5G technology. All of this supported with investments totalling €620 million for the development of satellite infrastructure - through Hispasat - and €115 million for the fibre optic business and the deployment of the 5G mobile network infrastructure within the scope of the Group's assets.

The growing demand for connectivity in all areas of society and the business world, and the desire to offer a universal quality service in rural areas to achieve the digitalisation of society, make it essential to combine technologies: fibre and satellite. The combination of both will enable the two subsidiaries of the Group, Hispasat and REINTEL, to maintain and strengthen the leadership of the Red Eléctrica Group in the field of telecommunications.

Furthermore, the Group today explained Hispasat's new strategic lines, which seek to transform this company in order to optimise the current business activity and take advantage of the opportunities offered by a sector undergoing technological change and which aims to provide a more direct service to citizens.

In this context, Hispasat's future lies in consolidating its traditional video business in the regions where it maintains a leading position, initiating a transformation to cover the new needs of the market, based on universal connectivity as a pillar of the digitalisation of economic sectors, mobility and data transmission, as the main growth vectors.

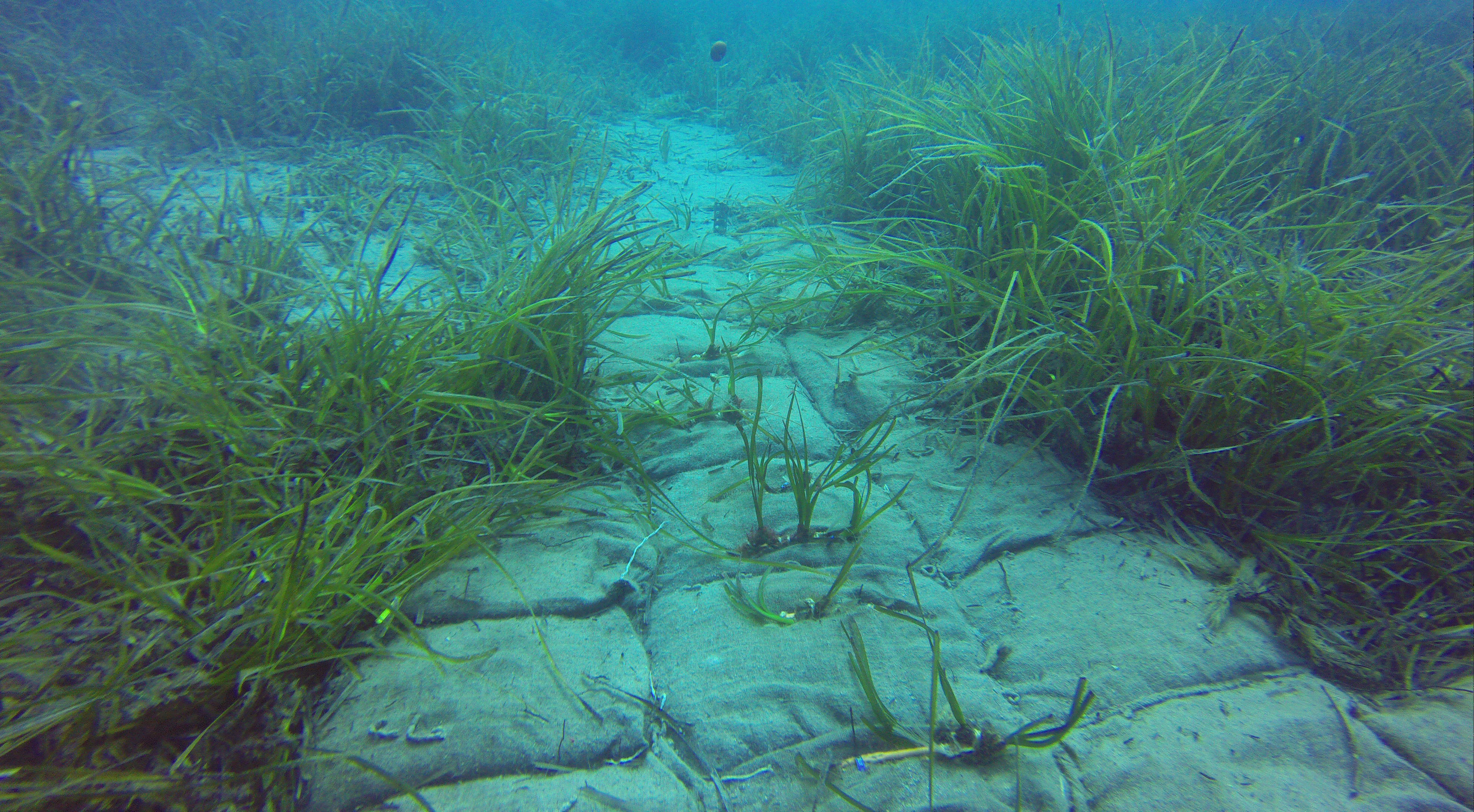

This change involves an evolution of the Company towards the provision of services, following the trend in the sector, based on the use of new technologies and alliances to provide coverage for the new services. In this regard, the Company is considering developing new verticals associated with air and sea connectivity, digitalisation of the primary sector, data analytics, as well as gaining greater exposure to resilient markets such as institutional or governmental services in the civil sector.

2020 Results

The Red Eléctrica Group today also released its financial information for 2020, a year in which the Group’s results reached €621.2 million in a year characterised by the entry into force of the new regulatory parameters and the effects of COVID, especially in the satellite business, which led the Group to update the valuation of Hispasat's assets.

Revenue totalled €1.986 billion. This figure shows lower income from electricity transmission activities in Spain, as a result of the application of the new remuneration parameters, which was largely offset by the higher in-come from the electricity system operation in Spain and the increase in telecommunication activity, due to the inclusion of Hispasat, which contributed €155 million. Gross operating profit (EBITDA) amounted to €1.569 billion, down 1% compared to 2019.

Investments by the Group during the year rose to €895 million, of which a total of €383 million was allocated to the development of the transmission grid in Spain. Additionally, the Company maintains its commitment to keep a dividend per share of 1 euro until 2022, and to keep it at least at 0.80 euros from that date onwards, in order to robustly support the strong investments foreseen.